Customer context

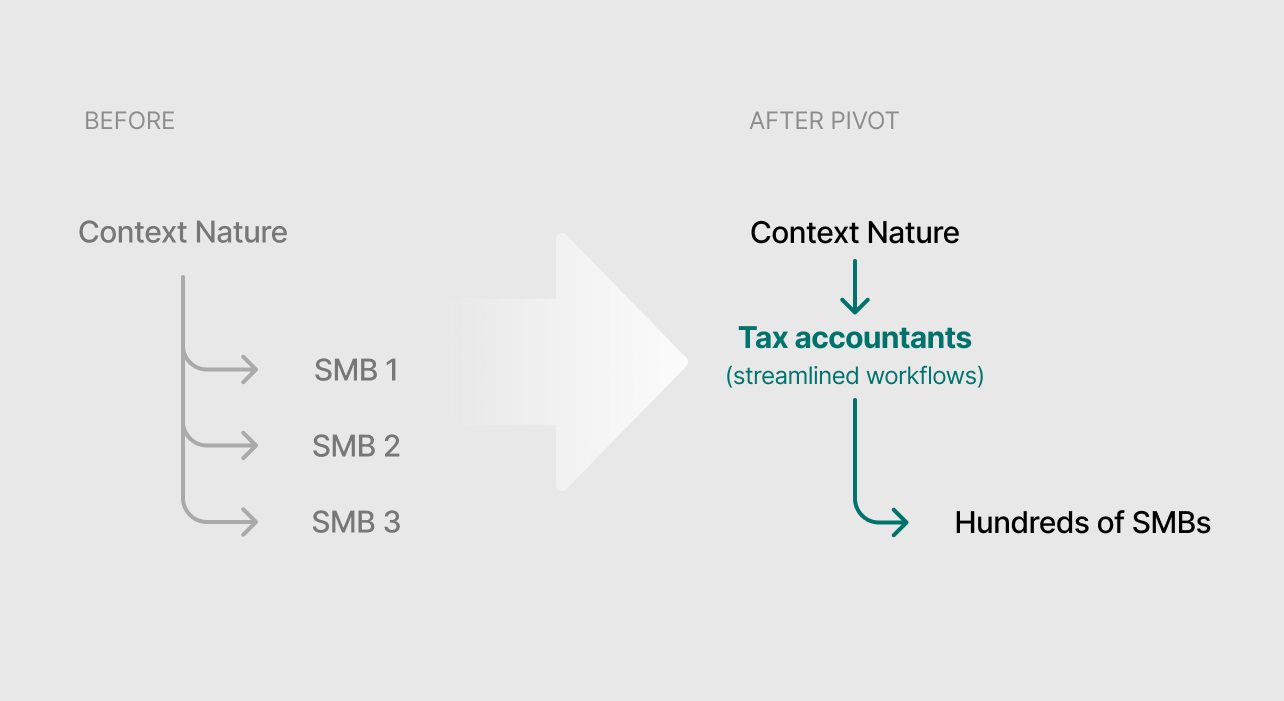

Small and medium sized businesses (SMBs) are essential to large-scale decarbonization, yet most fail to access green tax incentives. Our initial assumption was to educate SMBs and support their green tax credit applications.

Through early discovery, we learned the issue wasn’t awareness or intent. SMBs don’t control access—tax accountants do. Accountants operate under percentage-based fees and strict liability, making sub-$2M credits economically unattractive and risky to process.

My role

As the lead product designer, I owned system reframing, end-to-end discovery and validation, and human-centered AI design in a regulated financial ecosystem.

Strategic pivot

We decided to solve for intermediaries who control access to end users. By reducing accountant effort, we make previously unprofitable credits economically viable and unlock the entire SMB market. Additional discovery taught us that accountants need transparency and control; they'll only adopt automation they can verify, trace and override.

JTBD

To service more specialty tax credits, tax accountants were seeking to:

Grow revenue by serving more clients

Maintain quality standards & minimize risk

Operate efficiently without increasing workload

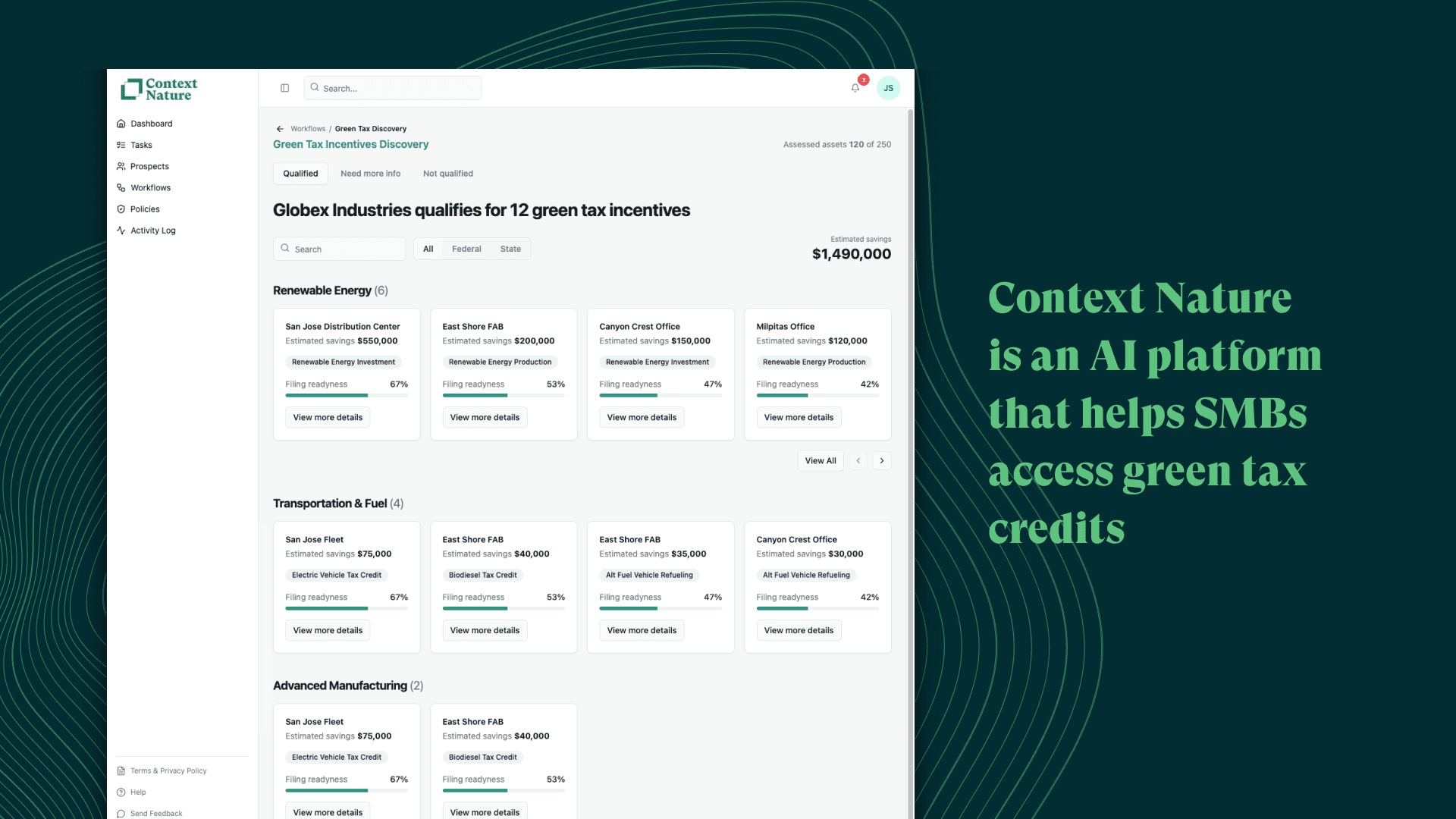

Solution

We built an AI-powered platform that automates tax credit discovery and documentation while preserving professional accountability. Key capabilities included:

Diagnostic tools & adaptive workflows enables faster assessment

Transparent automation with human-in-the-loop and structured data capture eliminates manual work

End-to-end case management with traceability improves auditability

Customer outcomes

80% faster discovery while maintaining accuracy and reducing operational risk and manual effort

Business impact: Expanded serviceable market

Shifted demand from outbound pilots to inbound interest via thought-leadership and webinars with the IRS / Treasury